nh property tax calculator

The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. All documents have been saved in Portable Document Format unless otherwise.

New Hampshire Property Taxes Can Be Complicated Concord Nh Patch

Salem Town Hall 33 Geremonty Drive Salem NH 03079 603 890-2000.

. How to Calculate Your NH Property Tax Bill. Tax amount varies by county. Comma separated values csv format.

Another option is to put more of your paycheck into an HSA or FSA if your employer offers it. For transactions of 4000 or less the minimum tax of. 186 of home value.

2013 City of Concord NH. The local tax rate where the property is situated. For comparison the median home value in Rockingham County is.

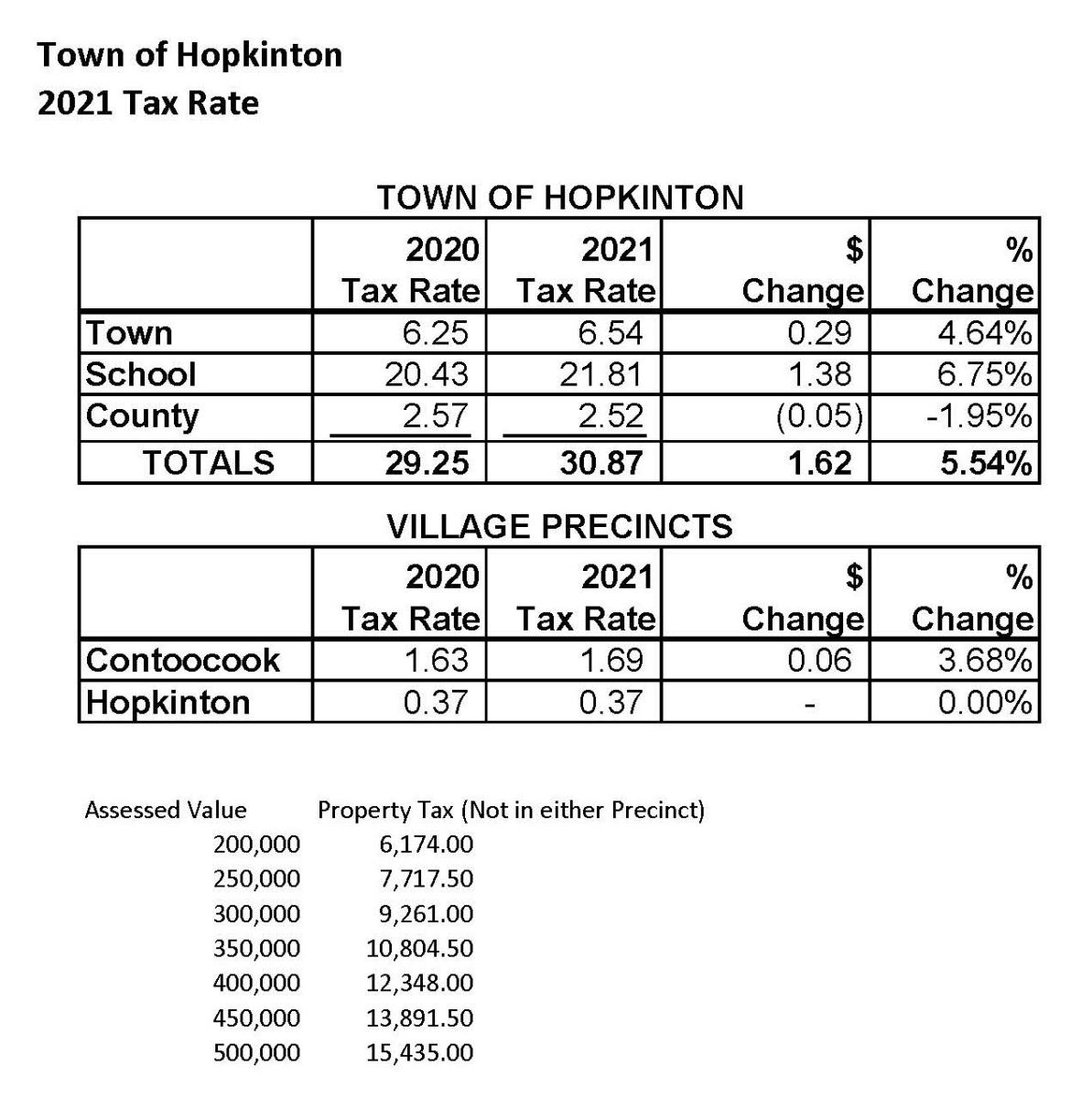

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. For example if your assessed value is 100000 and your tax rate is 10000 you will pay 10000 in property. The result is the tax bill for the year.

The assessed value multiplied by the tax rate equals the annual. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. 186 of home value.

The assessed value multiplied by the real estate. Get the inside scoop on what its. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

For all questions related to your property assessment. Online Property Tax Calculator Online Property Tax Calculator. Tax amount varies by county.

The City of Franklin offers residents an easy and convenient method to view and pay Property Tax Bills Online. Assessing department tax calculator. Enter as a whole number without spaces dollar sign or.

The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. If you make 70000 a year. For comparison the median home value in Grafton County is.

And while New Hampshire doesnt collect income taxes you can still save on federal taxes. Nh Property Tax Calculator. Your average tax rate is 1198 and your.

New Hampshire Income Tax Calculator 2021. This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our New Hampshire property tax records tool to get. The assessed value of the property.

Municipal reports prior to 2009 are available by request by calling the department at 603 230-5090. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. For comparison the median home value in New Hampshire is.

Property Tax by County Property Tax Calculator REthority from. If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. The 2021 real estate tax rate for the Town of Stratham NH is 1852 per 1000 of your propertys assessed value.

300000 1000 300 x 2306 6910 tax bill 1. Enter your Assessed Property Value in dollars - Example. The current 2021 real estate tax rate for the Town of Londonderry NH is 1838 per 1000 of your propertys assessed value.

Rye Sets Property Tax Rate For 2021 No Change In Overall Rate

Deducting Property Taxes H R Block

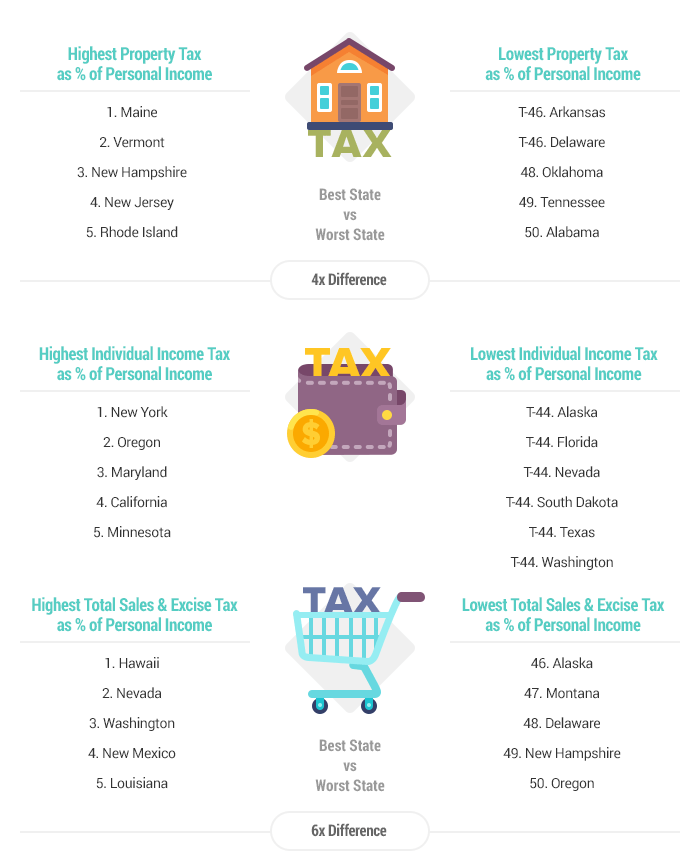

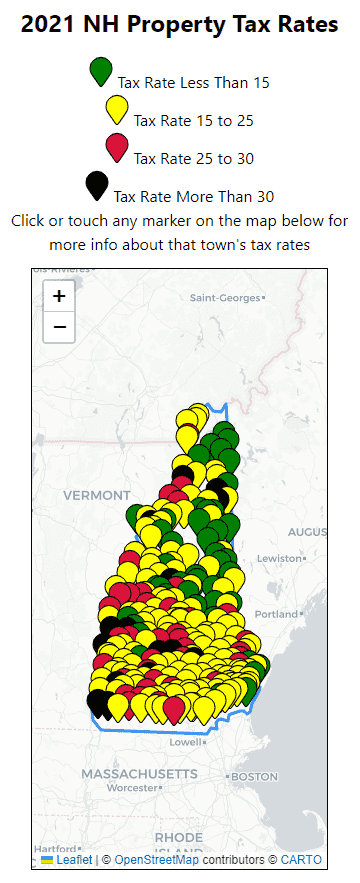

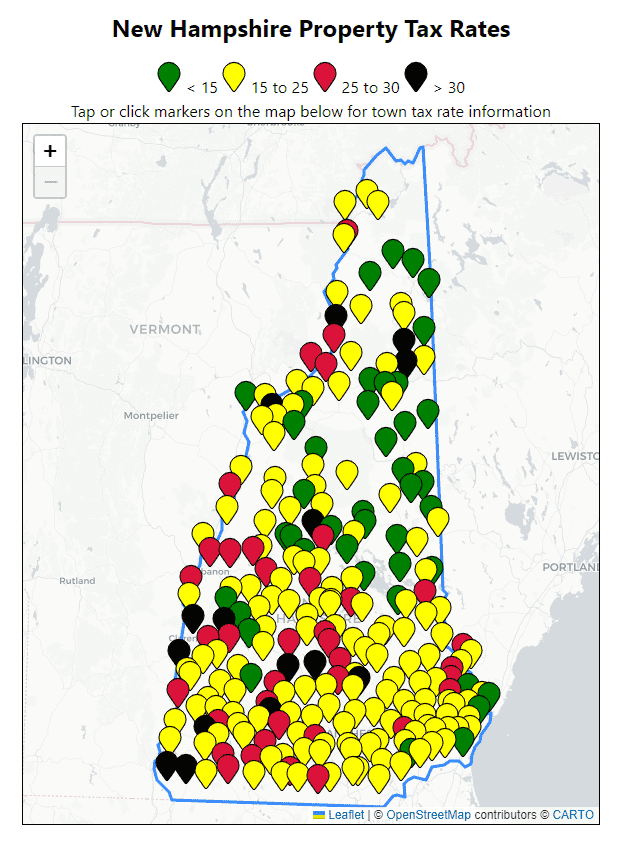

2021 New Hampshire Property Tax Rates Nh Town Property Taxes

Dover Tax Bills Go Up 245 90 For Average Single Family Homeowners

2021 Tax Rate Set Hopkinton Nh

Town Manager Announces Tax Rate Set At 26 36 Newmarket Nh

Live In Nh But Work In Ma What To Know About Your State Tax Returns Milestone Financial Planning

Litchfield 2021 Property Tax Rate Set Town Of Litchfield New Hampshire

2021 Tax Rate Set Town Of Nottingham Nh

Monadnock Ledger Transcript Report School Funding Method Used Across N H Isn T Fair To Students Or Taxpayers

Property Tax Calculator Smartasset

Understanding Property Taxes In New Hampshire Free State Project

Jaffrey New Hampshire The Town With The Highest Tax Rate In The State Moultonborough

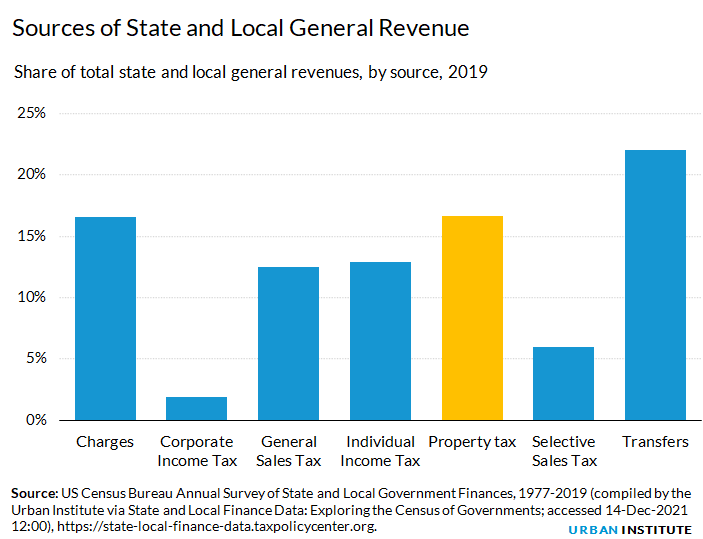

Property Taxes Urban Institute

Nh Has A Revenue Problem The Property Tax Nh Business Review

All Current New Hampshire Property Tax Rates And Estimated Home Values

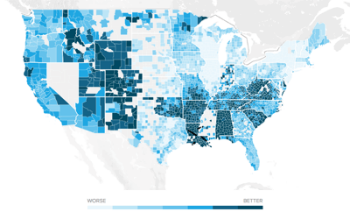

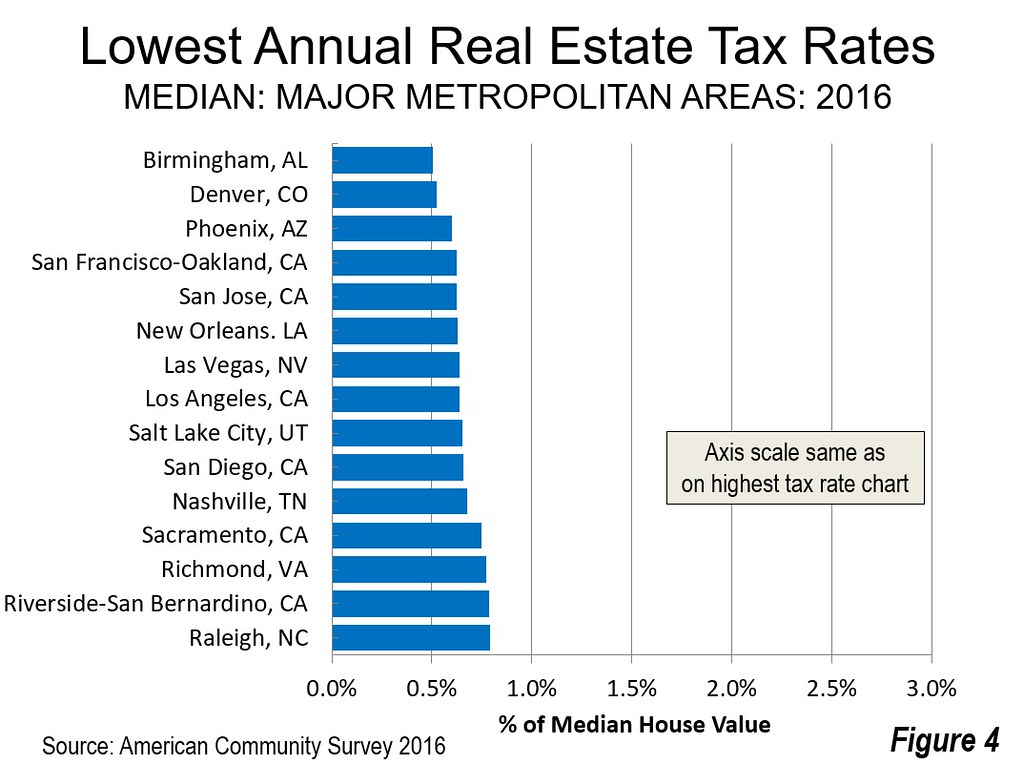

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com