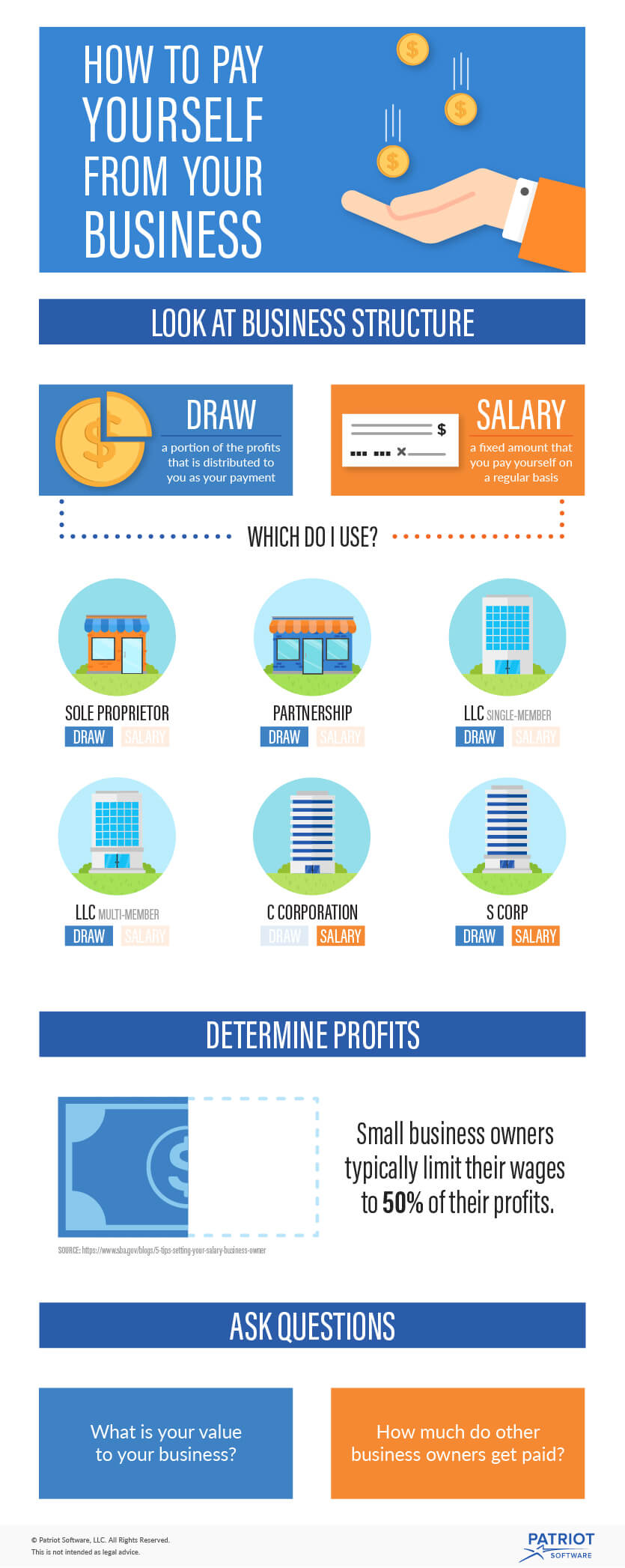

owner's draw vs salary

Suppose the owner draws 20000 then the. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner.

Kyle Meissner Are You Paying Yourself Correctly Business World Wenatcheeworld Com

Draws can tie directly to the companys.

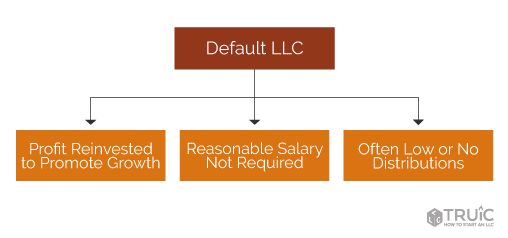

. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. But many business owners dont take a salary in the first few years. Your two payment options are the owners draw method and the salary method.

Instead of taking a draw the amount of which can vary per draw you can choose to take a salary instead. You dont need a salary. Here are a few.

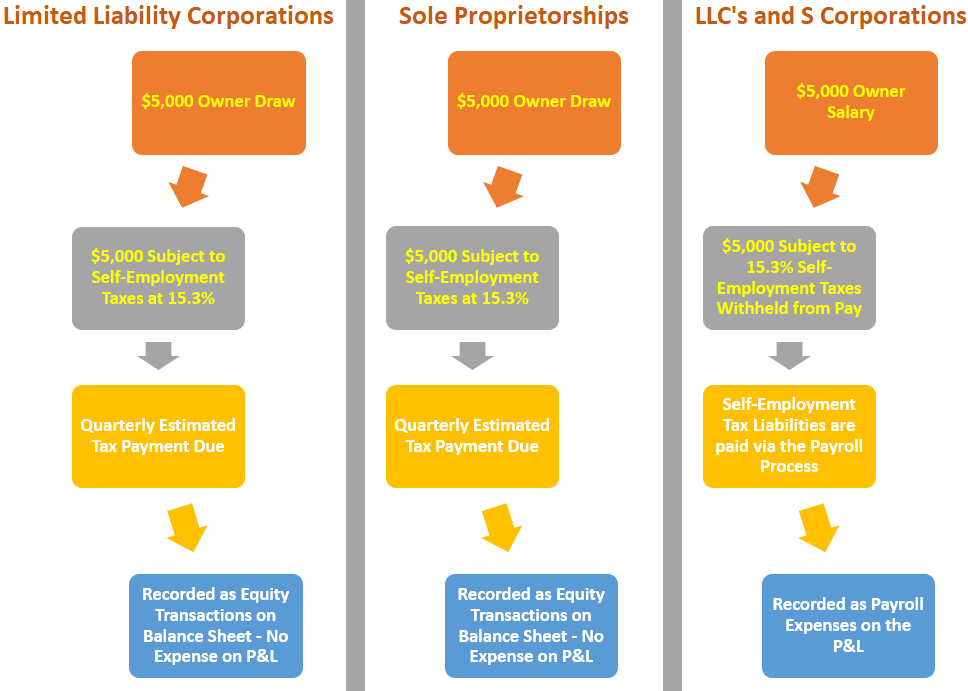

A salary on the other hand is a set. Up to 32 cash back Since the C-corp is typically owned by shareholders the earnings of the C-corp are owned by the company. Thus an owners draw is the way an owner pays himself rather than taking a salary from the business.

An owners draw refers to an owner taking funds out of the business for personal use. A company owners salary works pretty much in the same way that a. Owners Draw vs.

First lets take a look at the difference between a salary and an owners draw. Draw Method There are two primary ways of paying yourself. Data from Payscale shows that the average business owner makes 70220 per year.

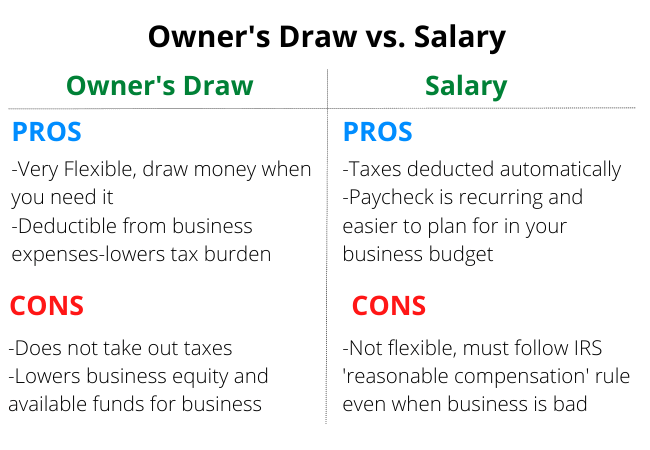

Taking Money Out of an S-Corp. Difference Between Owners Draw and Salary. Since owner draws are discretionary youll have the flexibility to take out more or fewer funds based on how the business is doing.

The owners draw option allows you to draw money from your business as and when you choose. In the former you draw money from your business as and when you see fit. If a C-corp business owner wants to.

Salary There are two main ways to pay yourself as a business owner owners draw and salary. When you pay yourself a salary you decide on a set wage for yourself and pay yourself a fixed amount every. Salary The owners draw method offers a greater level of flexibility than the salary method.

If an individual invests 30000 into a business entity and their share of profit is 18000 then their owners equity is at 48000. The funds drawn out of the business must be taken out of the. While there are other ways business owners pay themselves an owners draw or a draw and taking a salary are the.

Many small business owners compensate themselves using. What is an owners draw. When you do business in your own name as a sole proprietorship there isnt really such a thing as a salary or a.

Pros and Cons of Owners Draw vs. Generally the salary option is recommended for the owners. If Charlie takes out 100000 worth of an owners draw he runs the risk of not being able to pay employees salaries fabric costs and other various expenses.

Salary Vs Draw How To Pay Yourself As A Business Owner South Africa Small Business Centre

Salary Or Draw How To Pay Yourself As A Business Owner Asp

How To Pay Yourself As A Business Owner Smallbizgenius

Salary Vs Owner S Draw How To Pay Yourself As A Business Owner Article

This Is How Much To Pay Yourself As A Business Owner

How Do Small Business Owners Pay Themselves Fundera

Should I Pay Myself With A Salary Or Owner S Draw My Vao

How To Pay Yourself From Your Business Salary Vs Draw And How Much

Salary Or Draw How To Pay Yourself As A Business Owner Or Llc Quickbooks Global

Owner S Draw Vs Salary What S The Difference 1 800accountant

Owner S Draw Vs Salary How To Pay Yourself As A Business Owner

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc

What S The Average Small Business Owner Salary Hostpapa Blog

Understand How Small Business Owners Pay Themselves Track Self Employment Tax Liabilities Lend A Hand Accounting Llc

How Do I Pay Myself From My Llc Truic

How To Pay Yourself As A Small Business Owner Salary Vs Draw Start Your Business Youtube

1 800accountant Posts Facebook

How To Set Your Own Salary Small Business Owner Salary Calculator Gusto